Comenity Victoria Secret: Unlock the Secrets to Account Management and Reward Redemption

Delving into the Comenity Victoria’s Secret Credit Card: A Comprehensive Guide

The Comenity Victoria’s Secret credit card is an exclusive gateway to a world of exclusive perks, tailored rewards, and effortless account management. Designed to enhance the shopping experience of Victoria’s Secret enthusiasts, this card empowers you with a seamless and rewarding way to fulfill your lingerie and beauty aspirations. Join us as we embark on an in-depth exploration of the Comenity Victoria’s Secret credit card, revealing the secrets to unlocking its full potential.

Benefits that Bloom: Unveiling the Exclusive Perks

The Comenity Victoria’s Secret credit card is not merely a payment instrument; it’s a passport to an array of exclusive benefits that elevate your shopping experience. Here’s a closer look at the perks that await you:

1. Blossoming Rewards: Reap the Fruits of Every Purchase

With every purchase you make using your Comenity Victoria’s Secret credit card, you’ll be rewarded with points that accumulate towards alluring rewards. These points can be redeemed for a captivating array of merchandise, from the latest lingerie collections to tempting beauty products, all designed to ignite your senses and enhance your style.

2. VIP Access: Unlocking the Inner Sanctum of Victoria’s Secret

The Comenity Victoria’s Secret credit card grants you access to exclusive events, sneak peeks of upcoming collections, and personalized offers tailored to your unique preferences. As a cardholder, you’ll step into the inner sanctum of Victoria’s Secret, where the world of fashion and beauty unfolds before your eyes.

3. Financing Flexibility: Tailored to Your Needs

The Comenity Victoria’s Secret credit card offers flexible financing options to suit your lifestyle. Whether you prefer to spread out your payments over time or take advantage of special financing offers, the card empowers you with the freedom to make informed choices that align with your financial goals.

4. Peace of Mind: Ensuring Your Security and Privacy

Comenity takes your security and privacy seriously. The Comenity Victoria’s Secret credit card is equipped with advanced fraud protection measures to safeguard your personal and financial information. Shop with confidence, knowing that your transactions are protected by the latest security protocols.

5. Customer Service: A Dedicated Team at Your Fingertips

Comenity’s dedicated customer service team is available 24/7 to assist you with any questions or concerns you may have. Whether you need help managing your account, redeeming rewards, or resolving any issues, the team is committed to providing you with prompt and courteous support.

Unveiling the Secrets of Account Management: A Step-by-Step Guide

Managing your Comenity Victoria’s Secret credit card is a breeze with our step-by-step guide. Follow these simple steps to stay on top of your account and maximize its benefits:

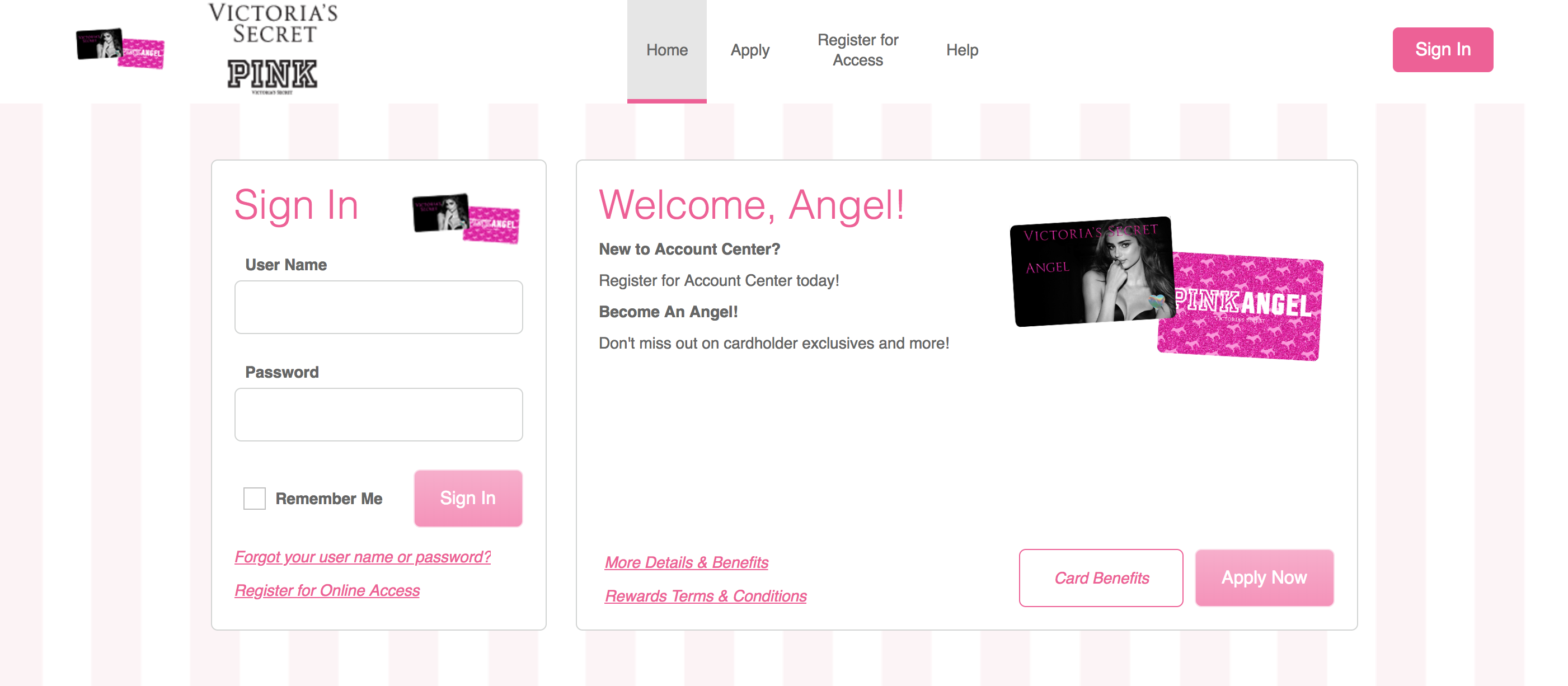

1. Online Account Access: Your Digital Command Center

Create an online account to gain instant access to your Comenity Victoria’s Secret credit card account. This secure portal empowers you to view your account balance, track your spending, redeem rewards, and manage your payment options. It’s a convenient way to stay in control of your account.

2. Mobile App: Banking on the Go

Download the Comenity mobile app for seamless account management on your smartphone. With the app, you can check your balance, make payments, view recent transactions, and redeem rewards anytime, anywhere. Manage your finances with ease and flexibility.

3. Automated Payments: Effortless and Timely

Set up automatic payments to ensure your bills are paid on time, every time. This convenient feature eliminates the hassle of remembering due dates and potential late fees. Choose the payment amount and frequency that suits you best.

4. Paperless Statements: Embracing a Greener Approach

Opt for paperless statements to reduce your environmental footprint and simplify your record-keeping. You’ll receive your monthly statements electronically, which you can store and access securely online.

5. Credit Line Increase: Expanding Your Spending Power

If you find yourself nearing your credit limit, you can request a credit line increase. Comenity will review your account history and other factors to determine your eligibility for an increase. This can provide you with additional spending flexibility when you need it most.

Unlocking the Power of Rewards: A Treasure Trove of Temptations

The Comenity Victoria’s Secret credit card rewards you for every purchase. Here’s how to maximize your rewards and indulge in a world of enticing perks:

1. Earn Points with Every Swipe

Every purchase you make using your Comenity Victoria’s Secret credit card accumulates valuable points. These points add up over time, unlocking access to an array of rewards and exclusive experiences.

2. Tiered Rewards: Ascend to Higher Levels of Rewards

The Comenity Victoria’s Secret credit card offers a tiered rewards program that elevates your earning potential. As you spend more, you’ll progress through different tiers, resulting in even more lucrative rewards.

3. Exclusive Rewards Catalog: A Universe of Temptations

Redeem your points for an enticing selection of rewards, including gift cards, merchandise, travel experiences, and more. The Comenity Victoria’s Secret rewards catalog is a treasure trove of temptations, catering to your every desire.

4. Personalized Offers: Tailored to Your Shopping Habits

Receive personalized offers and promotions tailored to your unique shopping preferences. These exclusive deals can help you save money and maximize your rewards.

5. Reward Redemption: Unleashing the Rewards

Redeeming your Comenity Victoria’s Secret rewards is a breeze. Simply log into your online account or use the mobile app to browse the rewards catalog and select the rewards that ignite your passion.

Unleashing the Potential of Comenity Victoria’s Secret Credit Card

The Comenity Victoria’s Secret credit card is a versatile financial instrument that can be tailored to your evolving needs. Here are some strategies for maximizing its potential:

1. Strategic Spending: Maximizing Rewards Accumulation

Use your Comenity Victoria’s Secret credit card for all your Victoria’s Secret purchases to accumulate points quickly. Consider making larger purchases during special promotions to earn bonus points.

2. Payment Discipline: Building a Strong Credit History

Pay your credit card bill in full and on time every month to maintain a strong credit history. Timely payments demonstrate your financial responsibility and can contribute to a higher credit score.

3. Responsible Borrowing: Avoiding Debt Traps

Use your Comenity Victoria’s Secret credit card responsibly and avoid carrying a balance that exceeds your ability to repay. This will help you maintain control of your finances and avoid potential debt issues.

4. Credit Monitoring: Staying Informed

Monitor your credit report regularly to track your credit score and identify any potential errors. This proactive approach can help you maintain a high credit score and protect your financial health.

5. Personalized Service: Tailored to Your Needs

Don’t hesitate to contact Comenity’s customer service team for personalized assistance. Whether you have questions about your account, rewards, or any other aspect of the card, the team is dedicated to providing you with tailored support.

Frequently Asked Questions: Unraveling the Mysteries

Here are some frequently asked questions about the Comenity Victoria’s Secret credit card, along with detailed answers to guide you:

1. How do I apply for the Comenity Victoria’s Secret credit card?

You can apply for the Comenity Victoria’s Secret credit card online, in-store at Victoria’s Secret locations, or by calling Comenity customer service.

2. What are the eligibility requirements for the Comenity Victoria’s Secret credit card?

To be eligible for the Comenity Victoria’s Secret credit card, you must be at least 18 years old, have a valid Social Security number, and meet Comenity’s creditworthiness criteria.

3. What is the APR for the Comenity Victoria’s Secret credit card?

The APR for the Comenity Victoria’s Secret credit card varies based on your creditworthiness and may change over time. You can find the current APR range on Comenity’s website.

4. How do I redeem my Comenity Victoria’s Secret rewards points?

You can redeem your Comenity Victoria’s Secret rewards points online through your account or via the mobile app. You can choose from a wide range of rewards, including gift cards, merchandise, and travel experiences.

5. What is the customer service phone number for Comenity Victoria’s Secret?

The customer service phone number for Comenity Victoria’s Secret is 1-800-695-9478. You can also contact customer service online through Comenity’s website.

Conclusion: Embracing the Rewards, Managing with Ease

The Comenity Victoria’s Secret credit card is a powerful tool that can elevate your shopping

Leave a Reply