Breaking: Unlocking The Latest On HCA Pay Stub – The Full Guide! – What You Didn’t Know!

What is an HCA Pay Stub?

An HCA pay stub is a document that provides employees with a detailed breakdown of their earnings and deductions for a specific pay period. It is typically issued on a bi-weekly or monthly basis and serves as an official record of the employee’s compensation.

Why is an HCA Pay Stub Important?

HCA pay stubs are important for a number of reasons. They allow employees to:

- Verify their earnings

- Track their deductions

- File their taxes

- Apply for loans or credit cards

- Serve as proof of income

li>Calculate their net pay

Understanding Your HCA Pay Stub

HCA pay stubs can vary in format, but they typically include the following information:

- Employee’s name and address

- Employer’s name and address

- Pay period

- Gross earnings

- Deductions

- Net pay

- YTD earnings

- YTD deductions

- YTD net pay

Earning Codes on Your HCA Pay Stub

Your HCA pay stub may include a number of different earning codes. These codes represent the different types of earnings that you have accrued during the pay period. Common earning codes include:

- Regular pay

- Overtime pay

- Holiday pay

- Vacation pay

- Sick pay

- Bonuses

- Commissions

Deduction Codes on Your HCA Pay Stub

Your HCA pay stub may also include a number of different deduction codes. These codes represent the different types of deductions that have been taken out of your pay. Common deduction codes include:

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

- Health insurance premiums

- Dental insurance premiums

- Vision insurance premiums

- 401(k) contributions

Reading Your HCA Pay Stub: A Step-by-Step Guide

Here is a step-by-step guide to reading your HCA pay stub:

1. Find Your Gross Earnings

Your gross earnings are the total amount of money that you have earned before any deductions have been taken out. This number is typically located at the top of your pay stub.

2. Identify Your Deductions

Your deductions are the amounts of money that have been taken out of your pay for various reasons. Deductions can include taxes, insurance premiums, and retirement contributions.

3. Calculate Your Net Pay

Your net pay is the amount of money that you receive after all deductions have been taken out. This number is typically located at the bottom of your pay stub.

Common Questions About HCA Pay Stubs

Here are some common questions about HCA pay stubs:

1. How often are HCA pay stubs issued?

HCA pay stubs are typically issued on a bi-weekly or monthly basis.

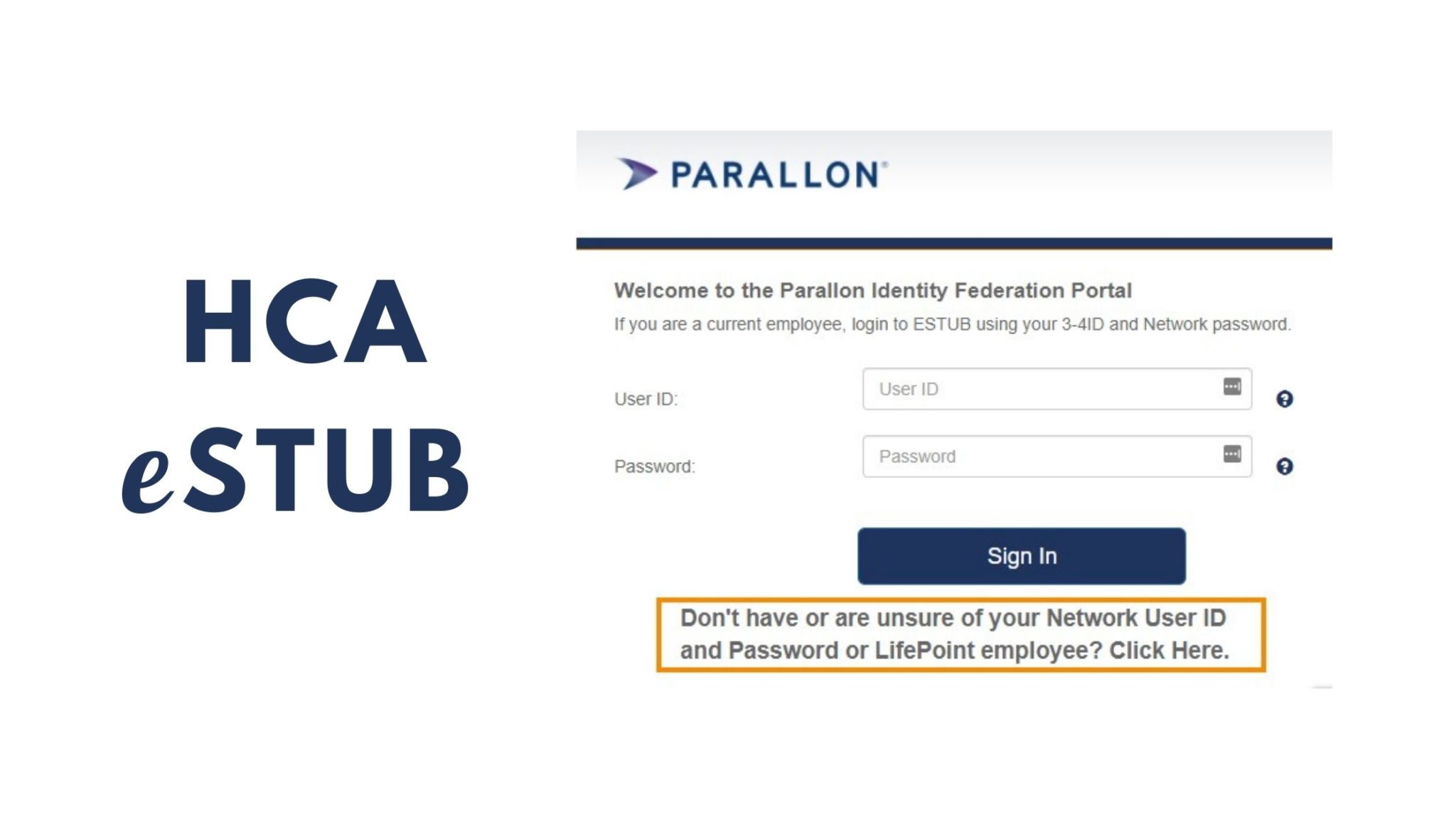

2. How can I view my HCA pay stub online?

You can view your HCA pay stub online by logging into the HCA employee portal.

3. What should I do if I have questions about my HCA pay stub?

If you have questions about your HCA pay stub, you should contact your supervisor or the HCA HR department.

Conclusion

HCA pay stubs are important documents that provide employees with a detailed breakdown of their earnings and deductions. By understanding how to read your HCA pay stub, you can ensure that you are receiving the correct amount of pay and that all deductions are being taken out correctly.

Leave a Reply