Unlocking The Latest On HCA Pay Stub – The Full Guide!

Understanding HCA Paycheck

Healthcare Corporation of America (HCA) is one of the largest healthcare providers in the United States. With over 180 hospitals and 2,000 clinics nationwide, HCA employs a vast workforce that relies on timely and accurate pay stubs.

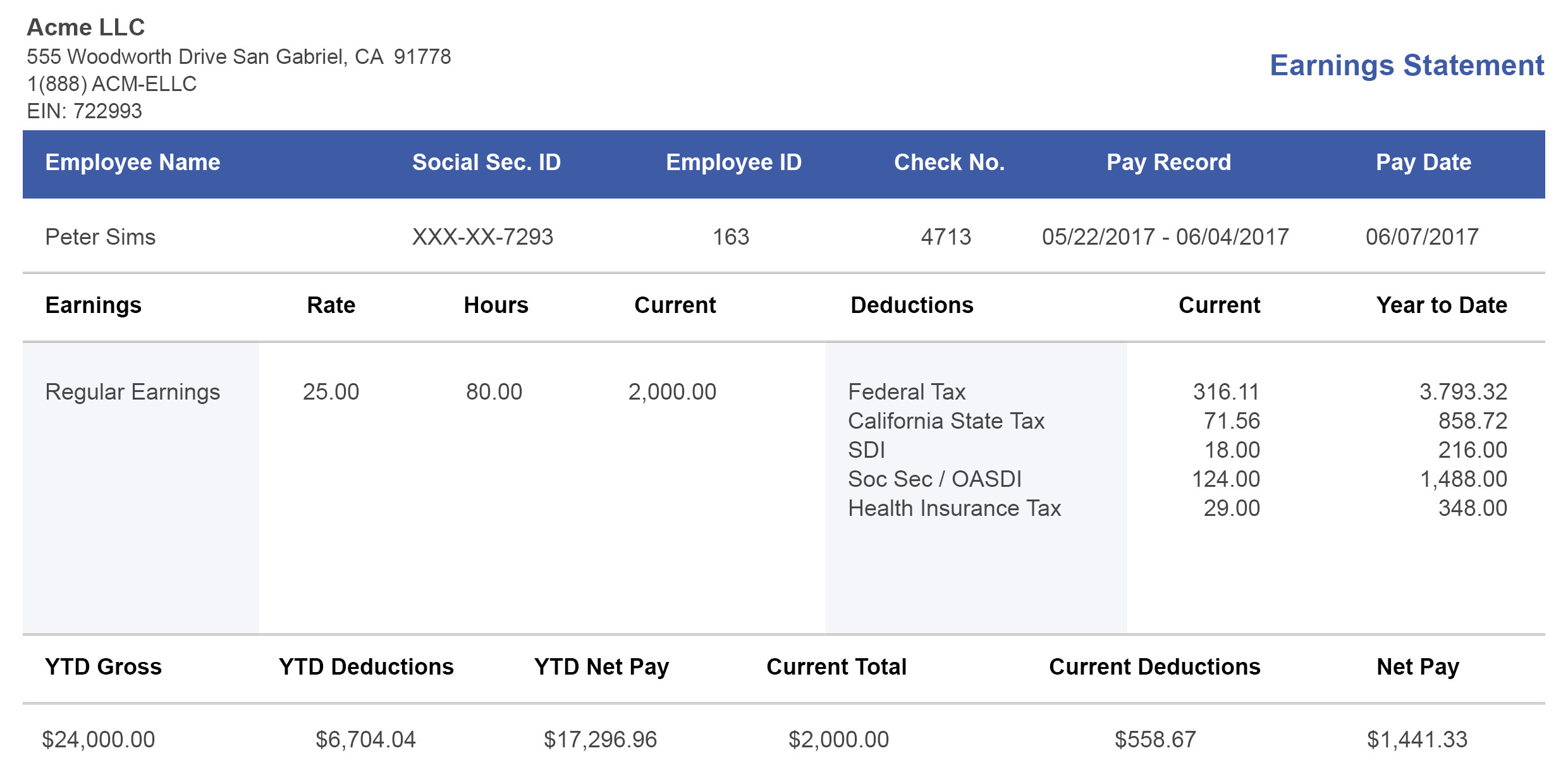

An HCA pay stub is a detailed record of an employee’s earnings, deductions, and other payroll-related information. It provides a clear breakdown of how an employee’s paycheck was calculated and helps ensure that they are being paid correctly.

Essential Information on Your Pay Stub

An HCA pay stub typically includes the following information:

- Employee’s name and ID

- Pay period dates

- Gross pay (total earnings before deductions)

- Net pay (total earnings after deductions)

- Hours worked

- Regular pay rate

- Overtime pay rate

- Deductions (e.g., taxes, health insurance premiums, retirement contributions)

- YTD (year-to-date) earnings and deductions

Understanding the information on your pay stub is essential for managing your finances effectively. It allows you to track your income, expenses, and tax obligations.

Accessing Your HCA Pay Stub

HCA employees can access their pay stubs online through the company’s employee self-service portal, MyHCA.

To access MyHCA:

- Go to the MyHCA website: https://myhca.hcahealthcare.com

- Enter your username and password

- Click on the “Pay” tab

- Select the pay stub you want to view

Benefits of Online Pay Stub Access

Accessing your pay stub online offers several benefits:

- Convenience: View your pay stub anytime, anywhere with an internet connection.

- Security: Your pay stub is protected by secure login credentials.

- Environmental friendliness: No need for paper printouts.

Understanding HCA Pay Codes

HCA pay stubs use a series of pay codes to identify different types of earnings, deductions, and other payroll-related information.

Common HCA pay codes include:

| Pay Code | Description |

|---|---|

| REG | Regular pay |

| OT | Overtime pay |

| HOL | Holiday pay |

| PTO | Paid time off |

| VAC | Vacation pay |

| SICK | Sick pay |

| BON | Bonus pay |

| COMM | Commission pay |

| 401K | 401(k) retirement plan contribution |

| FED | Federal income tax |

| FICA | Social Security and Medicare taxes |

| ST | State income tax |

| MED | Medicare tax |

| VOL | Voluntary deductions (e.g., health insurance premiums) |

Understanding these pay codes will help you interpret your pay stub accurately.

Common Questions about HCA Pay Stubs

Here are some common questions that employees have about HCA pay stubs:

How often am I paid?

HCA employees are typically paid bi-weekly.

When will I receive my pay stub?

Pay stubs are typically available online the day after payday.

What if I have questions about my pay stub?

If you have questions about your pay stub, you should contact your supervisor or the Human Resources department.

How can I view my pay stubs from previous years?

You can view your pay stubs from previous years by logging into MyHCA and selecting the appropriate year from the dropdown menu on the “Pay” tab.

Additional Tips for Managing Your Pay

Here are a few additional tips for managing your pay effectively:

- Review your pay stub carefully: Make sure that all information is correct and that you understand how your pay was calculated.

- Set up direct deposit: Have your paycheck automatically deposited into your bank account for convenience and security.

- Create a budget: Track your income and expenses to ensure that you are living within your means.

- Save for the future: Contribute to a retirement account or other savings plan to secure your financial future.

- Seek professional help if needed: If you have any questions or concerns about managing your pay, don’t hesitate to seek help from a financial advisor or credit counselor.

By following these tips, you can ensure that you are getting paid correctly, managing your finances effectively, and planning for the future.

Leave a Reply